UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended: June 30, 2020

|

The Gladstone Companies, Inc. |

|

(Exact name of issuer as specified in its charter) |

|

Delaware |

|

90-0528770 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1521 Westbranch Drive, Suite 100

McLean, Virginia 22102

(Full mailing address of principal executive offices)

(703) 287-5800

(Issuer’s telephone number, including area code)

For the Fiscal Year Ended June 30, 2020

TABLE OF CONTENTS

|

ITEM 1. |

|

|

3 |

|

|

ITEM 2. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

13 |

|

ITEM 3. |

|

|

27 |

|

|

ITEM 4. |

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS |

|

30 |

|

ITEM 5. |

|

|

30 |

|

|

ITEM 6. |

|

|

32 |

|

|

ITEM 7. |

|

|

33 |

|

|

ITEM 8. |

|

|

49 |

2

Defined Terms

Except where the context requires otherwise, in this Annual Report on Form 1-K (this “Annual Report”):

|

|

• |

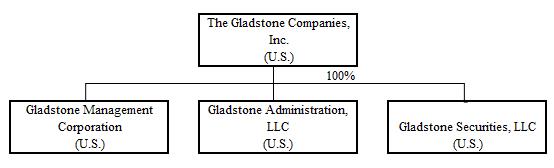

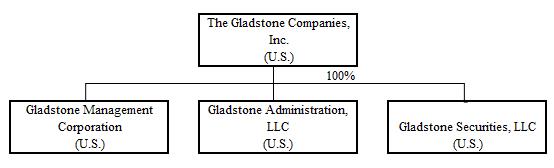

“Company,” “we,” “us” and “our” refer to The Gladstone Companies, Inc., formerly known as Gladstone Holding Corporation until a name change effective September 14, 2018, and its consolidated subsidiaries, including the Administrator Subsidiary, the Adviser Subsidiary and the Broker-Dealer Subsidiary; |

|

|

• |

“1940 Act” refers to the Investment Company Act of 1940, as amended; |

|

|

• |

“Advisers Act” refers to the investment Advisers Act of 1940, as amended; |

|

|

• |

“Administrator Subsidiary” refers to Gladstone Administration, LLC, a wholly-owned subsidiary of the Company that currently provides administrative services to the Existing Gladstone Funds; |

|

|

• |

“Adviser Subsidiary” refers to Gladstone Management Corporation, a wholly-owned subsidiary of the Company and a registered investment adviser that currently advises the Existing Gladstone Funds; |

|

|

• |

“BDC” refers to a business development company regulated under the 1940 Act; |

|

|

• |

“Broker-Dealer Subsidiary” refers to Gladstone Securities LLC, a wholly-owned subsidiary of the Company that is registered as a broker dealer with the SEC and is a member of FINRA and insured by the SIPC and provides certain investment banking, mortgage placement and dealer manager services to the Existing Gladstone Funds; |

|

|

• |

“Code” refers to the Internal Revenue Code of 1986, as amended; |

|

|

• |

“Existing Gladstone Funds” refers to GAIN, GLAD, GOOD and LAND, each of which is managed by the Adviser Subsidiary; |

|

|

• |

“FINRA” refers to the Financial Industry Regulatory Authority, Inc.; |

|

|

• |

“Future Gladstone Funds” refers to the three new funds that we expect to launch and manage through the Adviser Subsidiary: Gladstone Retail, Gladstone Farming and Gladstone Partners; |

|

|

• |

“GAIN” refers to Gladstone Investment Corporation and its consolidated subsidiaries (Nasdaq: GAIN); |

|

|

• |

“GLAD” refers to Gladstone Capital Corporation and its consolidated subsidiaries (Nasdaq: GLAD); |

|

|

• |

“Gladstone BDCs” and “our BDCs” refers collectively to GAIN and GLAD; |

|

|

• |

“Gladstone Farming” refers to Gladstone Farming L.P., a limited partnership to be formed in Delaware that is expected to be a privately offered fund that invests in agricultural operations in the United States; |

|

|

• |

“Gladstone Partners” refers to Gladstone Partners L.P., a Delaware limited partnership that is expected to be a privately offered fund that will invest alone or co-invest in new portfolio companies with the Gladstone BDCs; |

|

|

• |

“Gladstone REITs” refers collectively to LAND and GOOD; |

|

|

• |

“Gladstone Retail” refers to Gladstone Retail Corporation, a corporation formed in Maryland in 2020 that is expected to be a REIT that invests in retail properties; |

|

|

• |

“GOOD” refers to Gladstone Commercial Corporation and its consolidated subsidiaries (Nasdaq: GOOD); |

|

|

• |

“LAND” refers to Gladstone Land Corporation and its consolidated subsidiaries (Nasdaq: LAND); |

|

|

• |

“lower middle market” generally refers to companies with annual EBITDA of $3 million to $20 million; |

|

|

• |

“our funds” refers to the Existing Gladstone Funds and/or the Future Gladstone Funds, as the context may require; |

|

|

• |

“REIT” refers to a real estate investment trust under Section 856 of the Code; |

|

|

• |

“SEC” refers to the United States Securities and Exchange Commission; |

|

|

• |

“SIPC” refers to the Securities Investor Protection Corporation; and |

|

|

• |

“TGC LTD” refers to The Gladstone Companies, Ltd., a Cayman Islands exempted company, controlled by our Chairman, President and Chief Executive Officer, David Gladstone, which currently owns all of our outstanding shares of common stock. |

3

Performance Information Used in this Annual Report

Except where the context requires otherwise, in this Annual Report:

|

|

• |

“assets under management” is defined as the sum of the total assets of the Existing Gladstone Funds; |

|

|

• |

“incentive fees” refers to performance-based fees that the Adviser Subsidiary earns for advisory services provided to our funds, and for the Existing Gladstone Funds, generally consist of two parts: an income-based incentive fee and a capital gains-based incentive fee; |

|

|

• |

“investment advisory fees” (also referred to throughout this Annual Report as “base management fees”) refer to fees that the Adviser Subsidiary earns for advisory services provided to the Existing Gladstone Funds, which are generally based on a measure of adjusted gross assets for the Existing Gladstone Funds; |

|

|

• |

“EBITDA” refers to earnings before interest, taxes, depreciation and amortization; and |

|

|

• |

“hurdle rate” refers to a specified minimum rate of return on investments that a fund must exceed in order for the Adviser Subsidiary to receive certain incentive fees. |

Many of the terms used in this Annual Report, including assets under management, may differ from the calculations of other asset managers and as a result this measure may not be comparable to similar measures presented by other asset managers. In addition, our definition of assets under management is not based on any definition of assets under management that is set forth in the agreements governing the funds that we manage.

Overview

We were formed on December 7, 2009 as a Delaware corporation to continue the asset management business conducted through predecessor entities since 2001. Our sole stockholder is TGC LTD, which is controlled by David Gladstone, our Chairman, President and Chief Executive Officer.

Through our wholly-owned subsidiaries, we are an independent United States alternative asset manager with assets under management of approximately $3.0 billion as of June 30, 2020. Our alternative asset management businesses include the management, through our Adviser Subsidiary, of (1) GAIN, a BDC that primarily invests in debt and equity securities of lower middle market private businesses operating in the United States (including in connection with management buyouts, recapitalization or, to a lesser extent, refinancing of existing debt facilities); (2) GLAD, a BDC that primarily invests in debt securities of established private lower middle market companies in the United States; (3) GOOD, a REIT that focuses on acquiring, owning and managing primarily office and industrial properties in the United States; and (4) LAND, a REIT that focuses on acquiring, owning and leasing farmland in the United States. We also provide various administrative and financial services, including investment banking, due diligence, dealer manager, mortgage placement, and other financial services through our Broker-Dealer Subsidiary.

We have grown our assets under management significantly, from approximately $133.2 million as of September 30, 2001 to approximately $3.0 billion as of June 30, 2020, representing a compound annual growth rate (“CAGR”) of approximately 18%. Our Adviser Subsidiary oversees the investments of the four Existing Gladstone Funds which have collectively invested approximately $5.9 billion in 594 businesses or properties through June 30, 2020. As of June 30, 2020, we had 28 executive officers, managing directors and directors and also employed 41 other investment and administrative professionals through our Adviser Subsidiary and Administrator Subsidiary at our headquarters in McLean, Virginia (a suburb of Washington, D.C.) and our offices in New York, New York, Chicago, Illinois, Seattle, Washington, Dallas, Texas and Salinas, California. All such personnel are directly employed by either our Adviser Subsidiary or our Administrator Subsidiary.

We seek to deliver superior returns to investors in our funds through a disciplined, value-oriented investment approach. We believe that this investment approach, implemented across our broad and expanding range of alternative asset classes and investment strategies, helps provide stability and predictability to our business over different economic cycles and has contributed to our growth of assets under management over an extended period of time. Our investment personnel have cultivated strong relationships with clients in our financial advisory business through our Adviser Subsidiary, where we endeavor to provide objective and insightful solutions and advice that our clients can trust. We believe our scaled, diversified businesses, coupled with our long track record of investment performance, proven investment approach and strong client relationships, position us to continue to perform well in a variety of market conditions, expand our assets under management and add complementary businesses.

4

Assets under management were $3.0 billion as of June 30, 2020, an increase of $319 million, or 12%, compared to $2.7 billion at June 30, 2019. The following table sets forth assets under management (by Existing Gladstone Fund) as of June 30, 2020 and 2019.

|

(in millions) |

|

June 30, 2020 |

|

|

June 30, 2019 |

|

||

|

GAIN |

|

$ |

570.67 |

|

|

$ |

641.95 |

|

|

GLAD |

|

|

457.72 |

|

|

|

415.34 |

|

|

GOOD |

|

|

1,086.05 |

|

|

|

969.79 |

|

|

LAND |

|

|

856.69 |

|

|

|

628.72 |

|

|

Other Investments(1) |

|

|

60.79 |

|

|

|

55.12 |

|

|

Total |

|

$ |

3,031.92 |

|

|

$ |

2,710.92 |

|

|

(1) |

Other Investments consist of the assets of The Gladstone Companies, Inc. and its subsidiaries. |

Assets under management have increased since June 30, 2019, primarily as a result of the ability of the Existing Gladstone Funds to raise additional capital and effectively deploy such capital into new investments. As reflected in the table below, for the fiscal year ended June 30, 2020, this includes $661 million of new investments that were partially offset by investment repayments and sales of $223 million and negative changes in fund value of $118 million. These valuation changes primarily occurred in the second half of the fiscal year.

The following tables provide a roll-forward of assets under management (by Existing Gladstone Fund) for the fiscal years ended June 30, 2020 and 2019:

|

|

|

Fiscal Year Ended June 30, 2020 |

|

|||||||||||||||||||||

|

(in millions) |

|

GLAD |

|

|

GAIN |

|

|

GOOD |

|

|

LAND |

|

|

Other |

|

|

Total |

|

||||||

|

Beginning Balance, June 30, 2019 |

|

$ |

415.34 |

|

|

$ |

641.95 |

|

|

$ |

969.79 |

|

|

$ |

628.72 |

|

|

$ |

55.12 |

|

|

$ |

2,710.92 |

|

|

Investment Purchases and Additions |

|

|

154.66 |

|

|

|

94.54 |

|

|

|

165.76 |

|

|

|

246.31 |

|

|

|

— |

|

|

|

661.27 |

|

|

Investment Repayments and Sales |

|

|

(84.63 |

) |

|

|

(128.67 |

) |

|

|

(9.31 |

) |

|

|

— |

|

|

|

— |

|

|

|

(222.61 |

) |

|

Change in Fund Value |

|

|

(27.65 |

) |

|

|

(37.15 |

) |

|

|

(40.19 |

) |

|

|

(18.34 |

) |

|

|

5.67 |

|

|

|

(117.66 |

) |

|

Ending Balance, June 30, 2020 |

|

$ |

457.72 |

|

|

$ |

570.67 |

|

|

$ |

1,086.05 |

|

|

$ |

856.69 |

|

|

$ |

60.79 |

|

|

$ |

3,031.92 |

|

|

|

|

Fiscal Year Ended June 30, 2019 |

|

|||||||||||||||||||||

|

(in millions) |

|

GLAD |

|

|

GAIN |

|

|

GOOD |

|

|

LAND |

|

|

Other |

|

|

Total |

|

||||||

|

Beginning Balance, June 30, 2018 |

|

$ |

415.42 |

|

|

$ |

639.04 |

|

|

$ |

912.01 |

|

|

$ |

475.21 |

|

|

$ |

49.69 |

|

|

$ |

2,491.37 |

|

|

Investment Purchases and Additions |

|

|

134.45 |

|

|

|

133.23 |

|

|

|

101.41 |

|

|

|

147.30 |

|

|

|

— |

|

|

|

516.39 |

|

|

Investment Repayments and Sales |

|

|

(112.40 |

) |

|

|

(185.73 |

) |

|

|

(8.50 |

) |

|

|

(14.20 |

) |

|

|

— |

|

|

|

(320.83 |

) |

|

Change in Fund Value |

|

|

(22.13 |

) |

|

|

55.41 |

|

|

|

(35.13 |

) |

|

|

20.41 |

|

|

|

5.43 |

|

|

|

23.99 |

|

|

Ending Balance, June 30, 2019 |

|

$ |

415.34 |

|

|

$ |

641.95 |

|

|

$ |

969.79 |

|

|

$ |

628.72 |

|

|

$ |

55.12 |

|

|

$ |

2,710.92 |

|

Competitive Strengths

Diversified, National Alternative Asset Management. Alternative asset management is the fastest growing segment of the asset management industry, and we believe we are one of the leading mid-sized independent alternative asset managers in the United States. Our asset management business is diversified across a broad variety of alternative asset classes and investment strategies and has national reach and scale. From the time our Adviser Subsidiary entered the asset management business in 2001 through June 30, 2020, the Existing Gladstone Funds have raised approximately $2.4 billion of capital. Our assets under management have grown from approximately $133.2 million as of September 30, 2001 to approximately $3.0 billion as of June 30, 2020, representing a CAGR of approximately 18% over the 19-year period. We believe that the strength and breadth of our franchise, supported by our people, investment approach and track record of success, provide a distinct advantage when raising capital, evaluating opportunities, making investments, building value and realizing returns.

5

Stable Earnings Model. We believe we have a stable earnings model based on:

All of the equity capital that we currently manage is long-term in nature. As of June 30, 2020, 100% of our assets under management were in permanent capital vehicles with no fund termination or maturity date. None of the Existing Gladstone Funds has a requirement to return equity capital to investors. This has enabled and continues to enable us to invest assets with a long-term focus over different points in a market cycle, which we believe is an important component in generating attractive returns. We believe our long-term capital also leaves us well-positioned during economic downturns, when the fundraising environment for alternative assets has historically been more challenging than during periods of economic expansion.

We have a diverse capital base from four distinct funds. For the fiscal year ended June 30, 2020, approximately 18.3%, 38.6%, 18.8%, and 12.2% of our total fee revenue was generated from GLAD, GAIN, GOOD and LAND, respectively, with the balance arising from securities trade commissions and other income. We have a well-balanced and diverse capital base, which we believe is the result of our demonstrated expertise across alternative capital vehicles.

A significant portion of our revenue is generated from management fees. Management fees, which are generally based on the amount of invested capital in funds we manage, are generally more predictable and less volatile than performance-based fees. For the fiscal year ended June 30, 2020, approximately 35.9% of our total fee revenue was comprised of base management fees. For the years ended June 30, 2018, 2019 and 2020, base management fees averaged 38.3% of our total fee revenue.

Strong Middle Market Presence. While we have some exposure to large companies through tenants of certain GOOD properties, our business of investing in alternative assets includes substantial exposure to the United States middle market, which we define as United States businesses with $10 million to $1 billion in annual revenue. According to the National Center for The Middle Market, while the middle market represents just 3% of all United States companies, it accounts for a third of United States private sector gross domestic product and jobs, generates $6 trillion in annual revenue and employs 48 million people in the United States. Prior to the COVID-19 pandemic, the National Center for the Middle Market’s fourth quarter 2019 report reported that the year-over-year revenue growth rate of middle market companies was 7.5% as compared to 4.3% for companies comprising the S&P 500. In their report for the second quarter of 2020, following the start of the pandemic, this revenue growth rate has declined to -3.7%, but remains significantly better than the ‑13.9% decline for companies in the S&P 500. The projected revenue growth rate of middle market companies for the 12-month period ending June 30, 2021 is projected to be at 2.0%, versus 4.9% in their prior December 2019 projection.

Demonstrated Investment Track Record. We have a demonstrated record of generating attractive risk-adjusted returns across our asset management business. We believe that the investment returns we have generated for investors in the Existing Gladstone Funds over many years across a broad and expanding range of alternative asset classes and through a variety of economic conditions and cycles of the equity and debt capital markets are a key reason why we have been able to consistently grow our assets under management across our alternative asset management platform.

Diverse Base of Longstanding Investors. We have a long history of raising significant amounts of capital on a national basis across a broad range of asset classes, and we believe that the strength and breadth of our relationships with individual and institutional investors will provide us with a competitive advantage in raising capital. During the nearly two decades of asset management activities of our Adviser Subsidiary, we have built long-term relationships with many individual investors through brokerage houses and smaller institutional investors in the United States, most of which invest in a number of the Existing Gladstone Funds. Furthermore, the investor base of the Existing Gladstone Funds is highly diversified, with no single unaffiliated investor in the Existing Gladstone Funds owning more than 10% of the outstanding common stock of those funds as of June 30, 2020. We believe that our strong network of investor relationships, together with our long-term track record of providing investors in our funds with superior risk-adjusted investment returns, will enable us to continue to grow the Existing Gladstone Funds and successfully launch the Future Gladstone Funds.

Strong Industry and Corporate Relationships. We believe that the strength of our relationships with investment banking firms, other financial intermediaries and leading corporations and corporate executives provides us with competitive advantages in identifying transactions, securing investment opportunities and generating exceptional returns. We actively cultivate our relationships with major investment banking firms and other financial intermediaries. We believe our repeated and consistent dealings with these firms over a long period of time have led to our being one of the first parties considered for potential investment ideas and have enhanced our ability to obtain financing on more favorable terms. We believe that our strong network of relationships with these firms provide us with a significant advantage in attracting deal flow and securing transactions, including a substantial number of exclusive investment opportunities and opportunities that are made available to a very limited number of other private equity firms.

6

Our People. We believe that our executive officers and senior management, who average more than 29 years of experience in the business of the fund that they manage, are the key drivers in the growth of our business. Our executive officers and senior management are supported by other professionals with a variety of backgrounds in investment banking, leveraged finance, private equity, real estate and other disciplines. We believe that the extensive experience and financial acumen of our management and professionals provide us with a significant competitive advantage. We also believe that we benefit from substantial synergies across all of these businesses, including the ability to leverage the extensive intellectual capital that resides throughout our firm. We believe that the extensive investment review process that is conducted in all of our asset management businesses, involving active participation by David Gladstone, Terry Brubaker, David Dullum, Bob Cutlip, Bob Marcotte and Michael LiCalsi, is not only a significant reason for our successful investment performance but also helps to maximize those synergies. See “Directors and Officers” for additional background information for our executive officers.

Distinct Advisory Perspective. We are not engaged in activities that might conflict with our role as a trusted financial advisor. We believe that this makes us particularly well-suited to represent boards and special committees in the increasing number of situations where they are looking to retain a financial advisor who is devoid of such conflicts. In addition, we believe that our ability to view financial advisory client assignments from both the client’s and an owner’s perspective often provides unique insights into how best to maximize value while also achieving our clients’ strategic objectives.

Demonstrated History of Legal and Regulatory Compliance. We have a proven track record of launching and managing publicly traded BDC and REIT vehicles, each of which is subject to distinctive compliance and regulatory challenges. Rigorous legal and compliance analysis of our businesses and investments is important to our culture and our history of regulatory and legal compliance across all of our vehicles is a core strength of our firm.

Bond Offering and Our Growth Strategy

On September 8, 2020, the Company’s offering statement for its Tier 2, Regulation A offering (the “Bond Offering”) of $50 million of 7.0% Senior Secured Bonds which will mature on September 30, 2025 (the “Bonds”) was qualified by the SEC. The Bonds will bear interest at a rate equal to 7.0% per year payable to the record holders of the Bonds monthly in arrears on the first day of each month. The Bonds will be secured by a senior blanket lien on the equity interest we hold in the Future Gladstone Funds which are raised with the proceeds of the Bond Offering. The Bond Offering will terminate on the date that is the earlier of (1) September 30, 2023 (unless earlier terminated or extended by our Board of Directors) and (2) the date on which all $50,000,000 of the Bonds offered pursuant to the Bond Offering are sold. We may redeem the Bonds in whole or in part at any time or from time to time on or after September 30, 2023 (or at any time, if our Board of Directors determines, in its sole discretion, that the proceeds of the Bond Offering are insufficient for the intended use of proceeds) at a redemption price equal to 100% of the principal amount of the Bonds to be redeemed, plus any accrued, but unpaid interest to, but excluding, the redemption date. Bondholders will have no right to require us to redeem any of the Bonds prior to their maturity date except in the case of a holder’s death, subject to certain notice and other requirements, at a redemption price equal to 100% of the principal amount of the Bonds to be redeemed, plus any accrued, but unpaid interest to, but excluding, the redemption date. The Bonds will not be listed on a registered national securities exchange. Assuming the sale of all of the Bonds, the net proceeds, after selling commissions and dealer manager fees, would be approximately $45.5 million. We intend to use the proceeds from the Bond Offering to grow our assets under management by providing seed money to our Future Gladstone Funds, as outlined below, and for other possible new affiliated fund initiatives. As of the date of this Annual Report, we have not sold any of the Bonds.

New REIT for Investments in Retail Properties. We intend to invest up to $20 million of the proceeds from the Bond Offering as seed capital in Gladstone Retail through an interest in Gladstone Retail’s operating partnership, which has not yet been formed. Gladstone Retail would seek to purchase and own retail properties, which we define as locations that are open to the public and provide a product or service. These can include fast food restaurants, drug stores, auto dealerships, bank branches, supermarkets and health care service locations. We would lease the locations to qualified tenants with experience in the product or service to be offered. Our management has prior experience in evaluating, purchasing and leasing retail properties and we would use this expertise to focus on acquiring properties with strong potential current income and value appreciation. Gladstone Retail would not compete with GOOD because GOOD does not invest in retail properties. As of the date of this Annual Report, we have not identified specific properties that Gladstone Retail would seek to purchase.

New Fund to Invest in Farming Related Businesses. We intend to invest up to $20 million of the proceeds from the Bond Offering as seed capital in Gladstone Farming. Once launched, Gladstone Farming will seek to purchase agricultural operations across the United States that are focused on high-value crops such as organic vegetables, fruits and nuts and those of which may be converted to organic. As of the date of this Annual Report, we have not identified specific properties that Gladstone Farming would seek to purchase.

7

Gladstone Partners for Co-Investments with BDCs: We intend to invest up to $5 million of the proceeds from the Bond Offering as seed capital in Gladstone Partners. Gladstone Partners would invest alone or co-invest in new portfolio companies with the Gladstone BDCs. By using capital to co-invest with the Gladstone BDCs in this manner, we may take advantage of opportunities to make larger investments in portfolio companies, in the aggregate. Further, we believe that investing this seed capital in Gladstone Partners would enable Gladstone Partners to seek and obtain additional direct equity investments of cash from new unaffiliated investors in exchange for limited partnership interests therein. These additional investments would provide funding for Gladstone Partners to make future additional co-investments with GAIN and GLAD. Gladstone Partners does not intend to be regulated as a BDC under the 1940 Act. As of the date of this Annual Report, we have not identified specific co-investment opportunities in portfolio companies or loans that Gladstone Partners would seek to invest in.

We believe that the foregoing investments in our Future Gladstone Funds would add diversification to our portfolio of funds and, in certain circumstances, allow the funds that we manage to invest in larger investment opportunities. In addition to exploring entering into new businesses, we intend to continue to explore ways to expand our lines of business, as we have successfully done throughout our firm’s history, including by (1) adding new funds to our various asset management businesses (potentially including new structured debt and asset backed funds, new proprietary real estate funds and industry- or geography-specialized types of private equity funds) and otherwise pursuing ways to expand our assets under management in all of our businesses, and (2) continuing to attract to our firm individuals who can help us expand our asset management and financial services businesses into new investment or advisory areas and new geographic regions. To date, none of the Future Gladstone Funds listed above has conducted any business other than in connection with their initial formation. There is no assurance that we will be able to utilize the offering proceeds in the manner or amounts contemplated herein, or at all. We have not determined a likely order for the intended investments described above and may determine not to pursue one or more of the above funds. In the future, we may fund other real estate or portfolio company investments. Such future strategies may include investing in entities focused on purchasing and managing large farm operations, which we generally define as an operation exceeding $100 million in value, or investing in special purpose acquisition companies. We currently do not have any plans to enter into these long-term possibilities.

Financial Services

Financial services generally include receiving transaction-based compensation or other compensation for providing advice on a variety of strategic and financial matters, such as mergers, acquisitions and divestitures, restructurings and reorganizations and capital raising and capital structure. Such services are generally provided by investment banking firms, integrated commercial banks and specialized “boutique” financial firms. Advisors typically earn either a fixed fee or a fee based on a percentage of a transaction’s value, generally paid only when the transaction is completed.

In addition to the asset management services that we provide through our Adviser Subsidiary, we provide other financial services through our Broker-Dealer Subsidiary. Our Broker-Dealer Subsidiary receives various financial services fees, which typically consist of transaction-based fee and commission arrangements related to investment banking, due diligence, dealer manager, mortgage placement, and other financial services. Transaction fees are recognized when they are collected.

Over the five-year period ended June 30, 2020, we have generated $51.0 million in various fees through our financial services business, including $38.3 million of investment banking, annual review and property management fees and $12.7 million of securities trade commissions.

Administrative Services

The Administrator Subsidiary provides administrative services to the Existing Gladstone Funds as well as our Adviser Subsidiary and Broker-Dealer Subsidiary and is expected to provide such services for the Future Gladstone Funds. Its revenues equal its costs, as the Administrator Subsidiary’s purpose is to provide the requisite level of administrative services to the Existing Gladstone Funds (and to the Future Gladstone Funds) and our other subsidiaries at the lowest feasible cost. Additionally, the Administrator Subsidiary is responsible for producing the financial statements, asset valuations, handling compliance, legal, and other duties for us, the Existing Gladstone Funds, and our other subsidiaries.

The Administration Agreements for the Existing Gladstone Funds provide for payments equal to their allocable portion of the Administrator Subsidiary’s expenses incurred while performing services to them, which are primarily rent and salaries and benefits expenses of the Administrator Subsidiary’s employees, including each of the Existing Gladstone Funds’ chief financial officer and treasurer, chief compliance officer, chief valuation officer and general counsel and secretary (who also serves as the Administrator Subsidiary’s president).

8

The asset management and financial services industries are intensely competitive, and we expect them to remain so. We compete both nationally and on a regional, industry and niche basis. We compete on the basis of a number of factors, including investment performance, transaction execution skills, access to and cost of capital, business reputation, range and quality of products and services, innovation and price.

Asset Management. We face competition both in the pursuit of outside investors for the Existing Gladstone Funds and our Future Gladstone Funds and in acquiring investments in attractive portfolio companies and making other investments. Depending on the investment, we expect to face competition primarily from private equity funds, specialized investment funds, hedge fund sponsors, commercial banks and other financial institutions, corporate buyers and other parties, including, primarily, other BDCs and REITs. Many of these competitors are substantially larger and have considerably greater financial, technical and marketing resources than are generally available to us. Several of these competitors have recently raised funds, or are expected to raise funds, with significant amounts of capital and many of them have similar investment objectives to our funds, which may create additional competition for investment opportunities. Some of these competitors may also have a lower cost of capital and access to funding sources that are not available to us or the funds that we manage, which may create competitive disadvantages for us with respect to investment opportunities. In addition, some of these competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we want to make on behalf of our funds or through proprietary accounts. Corporate buyers may be able to achieve synergistic cost savings with regard to an investment that may provide them with a competitive advantage in bidding for an investment. Moreover, the allocation of increasing amounts of capital to alternative investment strategies by institutional and individual investors may lead to a reduction in the size and duration of pricing inefficiencies that many of our funds seek to exploit.

Financial Services. Our competitors are other financial advisory and investment banking firms. Our primary competitors in our financial advisory business are large financial institutions, many of which have far greater financial and other resources and much broader client relationships than us and (unlike us) have the ability to offer a wide range of products, from loans, deposit-taking and insurance to brokerage and a wide range of investment banking services, which may enhance their competitive position. Our competitors also have the ability to support investment banking, including financial advisory services, with commercial banking, insurance and other financial services revenue in an effort to gain market share, which puts us at a competitive disadvantage and could result in pricing pressures that could materially adversely affect our revenue and profitability.

Employees

As of June 30, 2020, we employed through our Adviser Subsidiary and Administrator Subsidiary 69 people, including 28 people who serve as our executive officers or as executive officers, managing directors (of investments) or directors (of investments) of the Existing Gladstone Funds, and 41 other investment and administrative professionals, all of which are full-time employees. We consider our relationship with our employees to be good and have not experienced interruptions of operations due to labor disagreements.

Regulatory and Compliance Matters

The asset management and financial services industries are subject to extensive regulation in the United States and elsewhere. The SEC and other regulators have in recent years significantly increased their regulatory activities with respect to alternative asset management firms. Certain of our businesses are subject to compliance with Federal and state laws and regulations, the oversight of their respective agencies and/or various self-regulatory organizations or exchanges, and any failure to comply with these regulations could expose us to liability and/or reputational damage. Our businesses have operated for a number of years within a legal framework that requires our being able to monitor and comply with a broad range of legal and regulatory developments that affect our activities. However, additional legislation, changes in rules promulgated by regulators or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect operation and profitability.

Rigorous legal and compliance analysis of our businesses and investments is important to our culture. We strive to maintain a culture of compliance through the use of policies and procedures such as oversight compliance, codes of conduct, compliance systems, communication of compliance guidance and employee education and training. We have a compliance group that monitors our compliance with all of the regulatory requirements to which we are subject and manages our compliance policies and procedures. Our Executive Vice President of Administration, General Counsel and Secretary, Michael LiCalsi, also serves as President of our Administrator Subsidiary, and thus supervises our compliance group, which is responsible for addressing all regulatory and compliance matters that affect our and the Existing Gladstone Funds’ activities. Our compliance policies and procedures address a variety of regulatory and compliance risks such as the handling of material non-public information, position reporting, personal securities trading, valuation of investments on a fund-specific basis, document retention, potential conflicts of interest and the allocation of investment opportunities.

9

Our Broker-Dealer Subsidiary, through which we primarily conduct our financial services business, is registered as a broker-dealer with the SEC and is a member of FINRA and the SIPC and is registered as a broker-dealer in all fifty states. Our Broker-Dealer Subsidiary is subject to regulation and oversight by the SEC and FINRA. Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of customers’ funds and securities, capital structure, record-keeping, the financing of customers’ purchases and the conduct and qualifications of directors, officers and employees. In recent years, the SEC and various self-regulatory organizations have aggressively increased their regulatory activities in respect of asset management firms.

SEC Regulation

Our Adviser Subsidiary is registered with the SEC as an investment adviser under the Advisers Act, and our BDCs, GLAD and GAIN, are regulated under certain provisions of the 1940 Act. As compared to other, more disclosure-oriented United States Federal securities laws, the Advisers Act and the 1940 Act, together with the SEC’s regulations and interpretations thereunder, are highly restrictive regulatory statutes. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act and the 1940 Act, ranging from fines and censures to termination of an adviser’s registration.

Under the Advisers Act, an investment adviser has fiduciary duties to its clients. The SEC has interpreted these duties to impose standards, requirements and limitations on, among other things, trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; use of “soft dollars,” a practice that involves using client brokerage commissions to purchase research or other services that help managers make investment decisions; execution of transactions; and recommendations to clients. On behalf of our investment advisory clients, we make decisions to buy and sell securities for each portfolio, select broker dealers to execute trades and negotiate brokerage commission rates.

The Advisers Act also imposes specific restrictions on an investment adviser’s ability to engage in principal and agency cross transactions. As a registered adviser, our Adviser Subsidiary is subject to many additional requirements that cover, among other things, disclosure of information about its business to clients; maintenance of written policies and procedures; maintenance of extensive books and records; restrictions on the types of fees it may charge; custody of client assets; client privacy; advertising; and solicitation of clients. The SEC has legal authority to inspect any investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities in compliance with (i) applicable laws, (ii) disclosures made to clients and (iii) adequate systems, policies and procedures to ensure compliance.

A majority of our revenues are derived from our Adviser Subsidiary’s provision of asset management services, including those provided to our BDCs. The 1940 Act imposes significant requirements and limitations on BDC funds, including with respect to its capital structure, investments and transactions. While our Adviser Subsidiary exercises broad discretion over the day-to-day management of these funds, every fund is also subject to oversight and management by a board of directors, a majority of whom are not “interested persons” as defined under the 1940 Act. The responsibilities of each board include, among other things, approving the advisory contract with the BDC; approving service providers; determining the valuation and the method for valuing assets; and monitoring transactions involving affiliates. Advisory contracts with the Gladstone BDCs may be terminated by either party or by the BDC’s stockholders on not more than 60 days’ notice and are subject to annual renewal by the BDC’s board of directors. In addition, under the 1940 Act, advisory agreements with 1940 Act funds (such as the Gladstone BDCs) terminate automatically upon assignment. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in us.

Generally, BDCs are prohibited under the 1940 Act from knowingly participating in certain transactions with their affiliates without prior approval of their board of directors who are not interested persons and, in some cases, prior approval by the SEC. The SEC has interpreted the prohibition on transactions with affiliates to prohibit “joint transactions” among entities that share a common investment adviser. On July 26, 2012, the SEC granted an exemptive order that permits GAIN, GLAD and any future BDC or closed-end management investment company that is advised by the Adviser Subsidiary (or sub-advised by the Adviser Subsidiary if it also controls the fund), or any combination of the foregoing, to co-invest subject to the conditions contained therein.

In certain situations where co-investment with one or more funds managed by the Adviser Subsidiary or its affiliates is not covered by the order, such as when there is an opportunity to invest in different securities of the same issuer, the personnel of the Adviser Subsidiary or its affiliates will need to decide which fund will proceed with the investment. Such personnel will make these determinations based on policies and procedures, which are designed to reasonably ensure that investment opportunities are allocated fairly and equitably, but do not entirely eliminate potential for a conflict of interest.

10

We do not own any real estate or other physical properties material to our operations. Our principal executive offices, which are leased by the Adviser Subsidiary, are located at 1521 Westbranch Drive, Suite 100, McLean, Virginia 22102. We also have offices in New York, New York; Chicago, Illinois; Seattle, Washington; Dallas, Texas; and Salinas, California. We consider these facilities to be suitable and adequate for the management and operation of our business as presently conducted.

Legal Proceedings

We may from time to time be involved in litigation and claims incidental to the conduct of our business. Our businesses are also subject to extensive regulation, which may result in regulatory proceedings against us. We are not currently subject to any pending judicial, administrative or arbitration proceedings that we expect to have a material impact on our results of operations or financial condition. See “Risk Factors—Risks Related to Our Business” that are incorporated by reference to this Annual Report.

Our business is subject to certain risks and events that, if they occur, could adversely affect our financial condition and results of operations. For a discussion of these risks, please refer to the section captioned “Risk Factors” in Part II of our Form 1-A/A - Offering Statement as filed with the SEC on September 3, 2020, which section is incorporated by reference herein. You should carefully consider these risk factors, together with risks the described herein and all of the other information included in this Annual Report and the other reports and documents filed by us with the SEC. These risks are not the only risks we face. Additional risks and uncertainties not presently known to us, or not presently deemed material by us, may also impair our operations and performance. If any of the following events occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. If that happens, you may lose all or part of your investment.

Risks Related to Our Business

Our business and that of the Existing Gladstone Funds has been, and in the future could be further, adversely affected by the recent coronavirus outbreak.

As of the date of this Annual Report, there is an outbreak of a novel and highly contagious form of coronavirus (COVID-19), which the World Health Organization has declared to constitute a Public Health Emergency of International Concern. The outbreak of COVID-19 has resulted in numerous deaths, adversely impacted global commercial activity and contributed to significant volatility in certain equity and debt markets. The global impact of the outbreak is rapidly evolving, and many countries, including the United States, have reacted by instituting quarantines, prohibitions on travel and the closure of offices, businesses, schools, retail stores and other public venues. Businesses are also implementing similar precautionary measures. Such measures, as well as the general uncertainty surrounding the dangers and impact of COVID-19, are creating significant disruption in supply chains and economic activity and are having a particularly adverse impact on transportation, hospitality, tourism, entertainment and other industries. As COVID-19 continues to spread, the potential impacts, including a global, regional or other economic recession, are increasingly uncertain and difficult to assess.

Any public health emergency, including any outbreak of COVID-19, SARS, H1N1/09 flu, avian flu, other coronavirus, Ebola or other existing or new epidemic diseases, or the threat thereof, could have a significant adverse impact on our businesses and the Existing Gladstone Funds and their portfolio companies and could adversely affect our results of operations.

The extent of the impact of any public health emergency, including the COVID-19 pandemic, on our and our businesses’ and funds’ operational and financial performance will depend on many factors, including the duration and scope of such public health emergency, the extent of any related travel advisories and restrictions implemented, the impact of such public health emergencies on overall supply and demand, goods and services, investor liquidity, consumer confidence and levels of economic activity and the extent of its disruption to important global, regional and local supply chains and economic markets, all of which are highly uncertain and cannot be predicted. For example, each of GLAD and GAIN records its assets at fair value. Between June 30, 2019 and June 30, 2020, both of these entities experienced a significant reduction in their gross assets, which primarily occurred in the quarter ended March 31, 2020. While there was some recovery by June 30, 2020, both had a negative change in fund value for the year. We expect that these reductions in gross assets will negatively impact the management fees that we receive from each of GLAD and GAIN for the fiscal year ending June 30, 2021 through the conclusion of the COVID-19 pandemic and potentially beyond. In addition, the incentive fees that we are entitled to receive from each of the Existing Gladstone Funds will be adversely affected to the extent that investment income (or its equivalent) is reduced whether as a result of the COVID-19 pandemic or otherwise. The COVID-19 pandemic has disrupted, and future public health emergencies may disrupt, the operations of the companies in which the Gladstone BDCs invest and the tenants of the Gladstone REITs. Certain of these companies and/or tenants have experienced a significant reduction of their

11

business activities, including as a result of shutdowns requested or mandated by governmental authorities, in connection with the COVID-19 pandemic (and may experience similar outcomes in connection with future public health emergencies). We cannot estimate the impact that a public health threat could have on the companies in which the Gladstone BDCs invest or the tenants of the Gladstone REITs, but it could disrupt their businesses and their ability to make interest, lease or dividend payments and decrease the overall value of the Existing Gladstone Funds’ investments and leasehold interests, which could adversely impact their business, financial condition or results of operations, which would adversely affect our revenues and results of operations.

Further, the operations of our businesses, the Existing Gladstone Funds and their portfolio companies may be significantly impacted, or even temporarily or permanently halted, as a result of government quarantine measures, voluntary and precautionary restrictions on travel or meetings and other factors related to a public health emergency, including its potential adverse impact on the health of the Adviser Subsidiary’s and the Administrator Subsidiary’s personnel. As a result, there is a risk that this crisis could adversely impact the ability of our businesses and funds to source, manage and divest investments and to achieve their investment objectives, all of which could result in lower base management and/or incentive fees earned by our Adviser Subsidiary, which could materially and adversely affect our business and results of operations.

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report contains forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “target,” “estimate,” “forecast,” “project,” by future conditional verbs such as “will,” “should,” “would,” “could” or “may,” or by variations of such words or by similar expressions. These statements are not historical facts, but instead represent our current expectations, plans or forecasts and are based on the beliefs and assumptions of management and the information available to management at the time that these disclosures were prepared.

Forward-looking statements are subject to numerous assumptions, risks (both known and unknown) and uncertainties, and other factors which change over time. Such factors include:

|

|

• |

reductions in assets under management by our Adviser Subsidiary based on investment performance, adverse changes in the economy and the capital markets and other factors, including the COVID-19 pandemic; |

|

|

• |

the loss of an Advisory Agreement with an Existing Gladstone Fund; |

|

|

• |

our ability to maintain historical returns of the Existing Gladstone Funds and sustain our historical growth; |

|

|

• |

the impact of COVID-19 generally and on the economy, the capital markets our business and the portfolio companies of the Gladstone Funds, including the measures taken by governmental authorities to address it; |

|

|

• |

our ability to retain key investment professionals or members of our senior management team; |

|

|

• |

our reliance on the technology systems supporting our operations; |

|

|

• |

availability of capital to the Existing Gladstone Funds; |

|

|

• |

our ability to successfully launch and grow the Future Gladstone Funds and develop new strategies and funds in the future; |

|

|

• |

the concentration of our investments in lower middle market businesses and real estate in the United States; |

|

|

• |

the ability of our investment teams to identify appropriate investment opportunities; |

|

|

• |

our exposure to potential litigation (including administrative or tax proceedings) or regulatory actions; |

|

|

• |

our ability to implement effective information and cyber security policies, procedures and capabilities; |

|

|

• |

our determination that we are not required to register as an “investment company” under the 1940 Act; |

|

|

• |

the fluctuation of our expenses and results of operations; |

|

|

• |

our ability to respond to recent trends in the asset management industry; |

|

|

• |

changes in governmental regulation (including regulation specific to the asset management industry), tax rates and similar matters and our ability to respond to such changes; |

|

|

• |

the degree and nature of competition in the asset management industry; |

|

|

• |

the level of control over us retained by David Gladstone; |

|

|

• |

our ability to deploy the proceeds of the Bond Offering with the Future Gladstone Funds or other changes to our business as a result of the proposed use of proceeds from the Bond Offering; and |

|

|

• |

other risks and factors listed under “Risk Factors” and elsewhere in this Annual Report. |

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Annual Report. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. Because forward-looking statements are subject to assumptions, risks, uncertainties, and other factors, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements and future results could differ materially from our historical performance.

13

The following discussion and analysis should be read in conjunction with the historical consolidated financial statements and the related notes included elsewhere in this Annual Report. The historical consolidated financial data discussed below reflect our historical results of operations and financial position.

Overview

We are a leading alternative asset manager and provider of other administrative and financial services. We currently provide these services to the four Existing Gladstone Funds, which are publicly traded, Nasdaq-listed companies invested in alternative asset classes:

|

|

• |

GAIN, a BDC, primarily invests in debt and equity securities of lower middle market private businesses operating in the United States (including in connection with management buyouts, recapitalizations or, to a lesser extent, refinancings of existing debt facilities). GAIN was established in 2005 and, like GLAD, is an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a BDC under the 1940 Act. In addition, it has elected to be treated as a RIC for Federal tax purposes under the Code.; |

|

|

• |

GOOD, a REIT, focuses on acquiring, owning and managing primarily office and industrial properties in the United States. GOOD was established in 2003 and is an externally-managed REIT; and |

|

|

• |

LAND, a REIT, focuses on acquiring, owning and leasing farmland and farm-related properties in the United States. LAND was established in 2013 and is an externally-managed REIT. |

We generate revenue from fees earned pursuant to advisory, administrative, broker-dealer and other agreements our subsidiaries have with the Existing Gladstone Funds and to other affiliated entities. These fees are generated through:

|

|

• |

the Adviser Subsidiary, an investment adviser registered with the SEC, which currently advises the Existing Gladstone Funds; |

|

|

• |

the Broker-Dealer Subsidiary, a broker dealer registered with FINRA and insured by the SIPC, which currently provides certain investment banking mortgage placement and dealer manager services to the Existing Gladstone Funds; and |

|

|

• |

the Administrator Subsidiary, which currently provides administrative services to the Existing Gladstone Funds, including accounting, valuation, legal, compliance, and other services. |

Our asset management business is operated through our Adviser Subsidiary, a registered investment adviser with the SEC, which has advisory agreements in place to manage all of the Existing Gladstone Funds. Our investment advisory business generated income before taxes of $8.6 million for the fiscal year ended June 30, 2020. Our assets under management have grown from approximately $133.2 million as of September 30, 2001 to approximately $3.0 billion as of June 30, 2020, representing a CAGR of approximately 18%. Since the inception of GLAD in 2001 through June 30, 2020, the Existing Gladstone Funds have invested in 594 businesses or properties for an aggregate amount of approximately $5.9 billion and paid $1.2 billion in common stock dividends or distributions to their investors.

Our Adviser Subsidiary has managed the Existing Gladstone Funds with a perspective of achieving successful growth over the long-term. In establishing and growing our various funds, and in determining the types of investments to be made by our funds, our management has consistently sought to focus on the best outcomes for our businesses and the Existing Gladstone Funds that we manage over a period of years, rather than on the short-term effect on our revenue, net income or cash flow. We believe that this approach will continue to significantly affect our revenue, net income and cash flow as a result of the timing of new investments and realizations of investments by the Existing Gladstone Funds, the Future Gladstone Funds and any other business or funds we may manage in the future.

As of the date of this Annual Report, we manage our operations on an aggregated, single segment basis for purposes of assessing performance and making operating decisions, and, accordingly, have only one reportable and operating segment. We provide asset management services through the Adviser Subsidiary and all of our revenues are generated within the United States.

14

We provide financial services through our Adviser Subsidiary and through our Broker-Dealer Subsidiary. The Broker-Dealer Subsidiary earns fees generated from providing dealer manager, investment banking, mortgage placement, and other services to us, the Existing Gladstone Funds and certain portfolio companies of GLAD and GAIN. We incur third-party securities trade costs associated with the Broker-Dealer Subsidiary that largely offset the associated securities trade commission revenue we earn.

Administrative Services

Our Administrator Subsidiary is a party to administration agreements with each of the Existing Gladstone Funds, as well as being a party to substantially similar agreements with us and our subsidiaries. Our Administrator Subsidiary provides accounting, legal, compliance, treasury, valuation, regulatory and other services pursuant to such agreements.

Our Revenues and Expenses

Our revenue is primarily derived from fees (pursuant to advisory agreements) our Adviser Subsidiary receives for managing the Existing Gladstone Funds. Such fees include investment advisory fees (also called base management fees) which are based upon assets or stockholders’ equity under management; loan servicing fees for serving as the servicer pursuant to line of credit agreements; performance-based incentive fees for meeting certain income or realized capital gains thresholds; and investment banking fees for providing investment banking, due diligence and management or advisory services. Our Broker-Dealer Subsidiary also receives fees for other financial services it provides to certain of the Existing Gladstone Funds and portfolio companies thereof, including distribution, investment banking, due diligence, dealer manager, mortgage placement and other financial services.

Historically, our most significant expense is the payment of salaries, bonuses and benefits for our employees, each of which is directly employed by either the Adviser Subsidiary or the Administrator Subsidiary.

Business Environment

As an asset management firm, our businesses are materially affected by conditions in the financial markets and economic conditions generally in the United States and, to a lesser extent, globally. Our diverse mix of businesses has allowed us to generate attractive returns across different business climates. Generally, business conditions characterized by low inflation, low or declining interest rates and strong equity markets provide a positive climate for us to generate attractive returns on existing investments. Since the Existing Gladstone Funds are closed-end funds with no requirement to return invested equity capital, we have generally been able to produce stable revenues. However, during periods of market volatility the fair value of the assets owned by the Existing Gladstone Funds will increase or decrease accordingly, which impacts the base management fees. In addition, during market downturns, certain portfolio companies and tenants of the Existing Gladstone Funds may no longer be able to make the payments due under the applicable agreement with an Existing Gladstone Fund, which may impact the income of the applicable Existing Gladstone Fund and incentive fees.

Market Conditions

Our ability to grow revenues in our asset management business largely depends upon the growth in assets under management and income in the Existing Gladstone Funds, Future Gladstone Funds, and in other businesses or funds we may manage in the future. Such growth will depend upon our ability to attract new capital and investors to our funds and our ability to successfully invest our funds’ capital. Our ability to grow our revenues in our financial services business (through our Broker-Dealer Subsidiary) depends largely on the ability of GLAD and GAIN (and in the future, Gladstone Farming or Gladstone Partners) to invest in new portfolio companies and the Broker-Dealer Subsidiary’s ability to source mortgages for GOOD and LAND (and in the future, Gladstone Retail), and the Broker-Dealer Subsidiary’s ability to provide effective dealer manager services to certain of the Existing Gladstone Funds’ and Future Gladstone Funds’ registered, non-listed issuances of stock or bonds, if any.

The global economy has experienced economic uncertainty in recent years. Economic uncertainty impacts our business in many ways, including through changing spreads, structures and purchase multiples, as well as the overall supply of investment capital. See “Risk Factors — Risks Related to Our Business” that are incorporated by reference to this Annual Report. As interest rates remain relatively low and public equities are not able to meet expected returns, we see increasing investor demand for alternative investments to achieve higher yields. As a result, some investors have increased their allocation to private markets relative to other asset classes. In addition, the opportunities in private markets have expanded as firms have created new vehicles and products in which to access private markets across different geographies and opportunity sets.

While COVID-19 hasn’t had a marked effect on the total revenue we have received related to the fiscal year ended June 30, 2020, it has negatively impacted certain elements of revenue in the six months ended June 30, 2020, particularly income-based

15

incentive fees from the Gladstone BDCs. As a result of decreases in their asset valuations, their net investment income was lowered, which is compared to a hurdle rate in determining any income-based incentive fees payable to the Adviser Subsidiary. With GAIN, we experienced a decrease of approximately $3.1 million in the income-based incentive fees between the fiscal year ended June 30, 2019 and the fiscal year ended June 30, 2020 that was a direct effect of their valuation changes which were primarily attributable to the impact of COVID-19. As discussed under Certain Financial Measures and Indicators – Revenues, reductions in incentive fees that we earn results in a corresponding decrease in the amount of incentive compensation that would be due under our carried interest incentive compensation plans.

Our revenues are directly impacted by the performance of the Existing Gladstone Funds, including any impacts they experience from COVID-19. Both GLAD’s and GAIN’s investment portfolio companies are diverse from an industry and geographic perspective, which should help mitigate any disproportionate effects of COVID-19 on specific industries and regions. In addition, while both GLAD and GAIN continue to monitor and work with their respective portfolio companies to navigate the significant challenges created by the COVID-19 pandemic, we believe that the portfolio companies of both GLAD and GAIN have taken actions to effectively and efficiently respond to such challenges. We believe both GLAD and GAIN have sufficient levels of liquidity to support their existing portfolio companies, as necessary, and selectively deploy capital in new investment opportunities.

We believe GOOD has a diverse tenant base from both a geography and industry perspective, without significant exposure to tenants in industries that have been significantly impacted by COVID-19, and GOOD has collected all cash rent obligations for the first half 2020 that were not subject to rent deferral agreements. GOOD entered into rent deferral agreements with three tenants in April 2020, which in the aggregate represent approximately 2% of GOOD’s total portfolio rents.

We do not believe that COVID has materially affected LAND’s operations or those of its tenants at this point in time. Most of LAND’s farmers initially experienced increased sales volumes and higher-than-average prices because the pandemic led the public to stockpile food and other necessities. However, such volumes and prices have recently returned to more normalized levels. LAND granted two rent deferrals for semi-annual rental payments due in July, which in the aggregate represent approximately 0.7% of LAND’s total portfolio rents, due to delays in payments owed to the tenants from their respective processors due to COVID-related government mandated lockdowns. We currently expect values of LAND’s farmland portfolio to remain stable, and with the exception of the rent deferrals granted to the two aforementioned tenants in July 2020, we expect rental payments due to LAND to continue to be paid on time for at least the foreseeable future.

Trends Affecting our Business

In addition to general market conditions, we believe the following trends will impact our future performance:

|

|

• |

Increasing Importance of Alternative Assets. Over the past several years, investor groups of all types have meaningfully increased their capital allocations to alternative investment strategies. We expect this current trend will continue as the combination of volatile returns in public equities and low-yields on traditional fixed income investments shifts investor focus to the lower correlated and absolute levels of returns offered by alternative assets. In particular, real assets, private equity and private debt strategies are expected to achieve significant growth as investors diversify to reduce volatility and achieve higher yields. |

|

|

• |

Increasing Demand for Alternative Assets from Retail Investors. Defined contribution pension plans and retail investors are demanding more exposure to alternative investment products to seek differentiated returns as well as to satisfy a desire for current yield due to changing demographics. We have benefited from this growing demand, given our diverse alternative offerings through publicly traded vehicles. With an established market presence, we believe we are well positioned to take advantage of the growing opportunity in the retail channel. |

|

|

• |

Shifting Asset Allocation Policies of Institutional Investors. We believe that the growing pension liability gap is driving investors to seek higher return strategies and that institutional investors, such as insurance companies, are increasingly rotating away from core fixed income products towards more liquid alternative credit and absolute return-oriented products to achieve their return hurdles. According to Ernst & Young, institutional investors allocated an estimated 25% of the global portfolio towards alternative strategies in 2019, up from approximately 12% in 2009. The increase in allocation has also been accompanied by a change in allocation strategy to a more balanced approach between private equity and non-private equity alternative investments. Our combination of credit expertise, total return and multi-strategy product offerings are particularly well suited to benefit from these asset allocation trends. |

16

|

|

returns, which ultimately affects our current income and ability to attract additional capital. Prior to the onset of the COVID-19 pandemic, United States and relevant global debt markets have been particularly robust in recent years, contributing to our ability to finance acquisitions by the Existing Gladstone Funds at attractive rates, leverage ratios and terms. A reduction in leverage ratios or a tightening of covenants and other credit terms could also negatively impact the assets under management or income of our Existing Gladstone Funds and our Future Gladstone Funds and the fees the Adviser Subsidiary earns under the Advisory Agreements. |

|

|

• |

Interest Rate Risk. Fluctuations in interest rates may affect the performance of the Existing Gladstone Funds and Future Gladstone Funds. Historical trends in these markets are not necessarily indicative of future performance in these funds. Current interest rates are near long-term historical lows; however, credit spreads have increased with the recent decline in interest rates, mitigating a portion of the decline in investment yields. Increases in rates and decreases in credit spreads would have a mixed impact on our performance as asset yields would tend to rise but so would the cost of servicing floating-rate debt used to leverage the Existing and Future Gladstone Funds, which could impact the performance-based incentive fees that the Adviser Subsidiary earns. However, we believe that we and the Existing Gladstone Funds are well-positioned for a rising interest rate environment, as the floating rate investments in these funds are substantially greater than their floating rate debts. |

|

|

• |

Competition among alternative asset managers. Our ability to grow our revenue is dependent on our continued ability to source attractive investments for the funds we manage and to deploy the capital that we have raised. Our transaction volume is largely based on relationships that we cultivate in the debt, equity, real estate and natural resource markets. Deviations from these relationships can occur in any given year for a number of reasons. We compete against a number of other public and private asset managers that are larger than us or have more diversified sources of revenue or stronger relationships in the sectors in which we operate. A significant decrease in the quality or quantity of investment opportunities or an increase in competition from new alternative asset management entrants could adversely affect our ability to source investments with returns that meet the investment objectives of the funds we manage. |

|

|

• |

Unpredictable global macroeconomic conditions. Global economic conditions, including political environments, the impact of pandemics such as COVID-19, financial market performance, interest rates, credit spreads or other conditions beyond our control, all of which affect the performance of our funds’ underlying investments, are unpredictable and could negatively affect our performance and that of the funds that we manage and their and our ability to raise funds in the future. |

|

|

• |

Increasing regulatory requirements. The complex regulatory and tax environment for asset managers could restrict our operations and subject us to increased compliance costs and administrative burdens, as well as restrictions on our business activities. |

We believe recent market conditions have created both favorable and unfavorable environments for our asset management and financial advisory businesses during the periods presented. Changes in these market conditions could have positive or negative effects on our asset management and financial advisory businesses in future periods, and those effects could be material. For a more detailed description of how economic and global financial market conditions can materially affect our financial performance and condition, see “Risk Factors—Risks Related to Our Business” that are incorporated by reference to this Annual Report. Our historical results of operations are not indicative of the expected future operating results.

Certain Financial Measures and Indicators

Consolidation

We consolidate the financial results of entities we control through a majority voting interest (including the Adviser Subsidiary, the Broker-Dealer Subsidiary, and the Administrator Subsidiary) as well as entities that are determined to be variable interest entities where we are deemed to be the primary beneficiary of the entity. While the Adviser Subsidiary is the investment adviser to the Existing Gladstone Funds, it does not hold a majority of the voting interests in any of the Existing Gladstone Funds, and thus, for accounting purposes and reporting purposes, we do not consolidate the Existing Gladstone Funds in our financial statements. The base management fees and incentive fee compensation received from the advisory agreements between our Adviser Subsidiary and the Existing Gladstone Funds are the only aspects of the Existing Gladstone Funds that are recorded in our financial statements.

17