The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 8, 2021

PRELIMINARY PROSPECTUS

Shares

Class A Common Stock

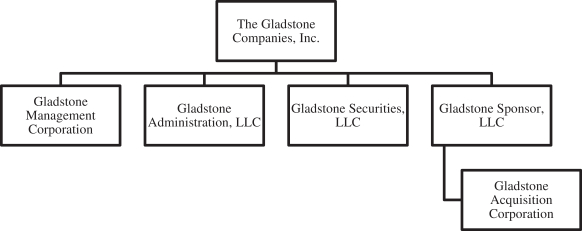

This is the initial public offering of shares of Class A Common Stock of The Gladstone Companies, Inc. We are offering shares of Class A Common Stock, par value $0.01 per share. This is our initial public offering of Class A Common Stock, and no public market currently exists for our Class A Common Stock. We anticipate that the initial public offering price will be between $ and $ per share of Class A Common Stock. We intend to apply to list our Class A Common Stock on the Nasdaq Global Select Market (“Nasdaq”), under the symbol “TGCI.”

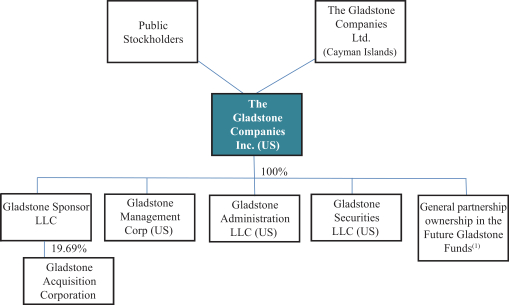

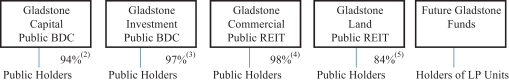

Following this offering, we will have two classes of common stock: Class A Common Stock and Class B Common Stock. The rights of the holders of Class A Common Stock and Class B Common Stock will be identical, except with respect to voting, conversion and transfer rights. Each share of Class A Common Stock is entitled to one vote. Each share of Class B Common Stock is entitled to ten votes and is convertible at any time into one share of Class A Common Stock. See the Section titled “Description of Capital Stock—Class A Common Stock and Class B Common Stock.” Our Chairman, President and Chief Executive Officer and his controlled entities hold % of our outstanding Class B Common Stock and will hold approximately % of the voting power of our outstanding capital stock immediately following this offering, assuming no exercise of the underwriters’ option to purchase additional shares of Class A Common Stock to cover over-allotments.

Upon the completion of this offering, The Gladstone Companies, Ltd., which is wholly owned and controlled by our Chairman, President and Chief Executive Officer, David Gladstone, will own all of our outstanding Class B Common Stock, which will represent % of the total voting power of our outstanding capital stock. As a result, we will be a “controlled company” within the meaning of the corporate governance rules of Nasdaq.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our Class A Common Stock involves risks. Please read “Risk Factors” beginning on page 23 of this prospectus.

| Price per Share |

Total | |||||||

| Initial public offering price of Class A Common Stock |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional shares of Class A Common Stock at the public offering price, less the underwriting discounts and commissions. In addition, at our request, the underwriters have reserved shares for sale to the members of our Board of Directors, officers and employees of us and our affiliates at the public offering price. The underwriting discount on any shares purchased by such individuals will be $ per share. See “Underwriting”.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A Common Stock on or about , 2022.

Book-Running Manager

EF HUTTON

division of Benchmark Investments, LLC

Prospectus dated , 2022.